What Happened to Buffet? Discover His Latest Moves Now

Buffet, the legendary investor and billionaire, is always a topic of discussion for investors and finance enthusiasts. People are always curious about what he is up to and what he is investing in. This article will dive into the latest news and updates on what Buffet is currently investing in and his strategy.

Buffet Backs Up Apple

One of the most significant investments Buffet has been making over the past few years has been in Apple stocks. Buffet’s company, Berkshire Hathaway, has been steadily investing more money in the tech giant. In fact, as of May 2021, Berkshire Hathaway owns about 5.4% of Apple’s total shares, which is worth approximately $120 billion.

The reason behind Buffet’s interest in Apple is because of its products and services that have become part of people’s daily lives. Apple’s revenue streams from iPhones, iPads, AirPods, and other devices have allowed them to continually grow their business. Buffet believes that Apple has a product ecosystem that is irreplaceable, making it a valuable investment opportunity for years to come.

Buffet’s Love for Financial Services

It comes as no surprise that Buffet is also investing in the financial services industry. Buffet has a long-standing reputation for investing in well-run companies with stable finances. Two of the most significant financial companies that Buffet has stakes in are American Express and JPMorgan Chase .

Buffet has invested over $18 billion in American Express, which has been in his portfolio for over 30 years. Similarly, Buffet has a $13 billion stake in JPMorgan Chase. The reason for his love for the financial industry is because Buffet is against debt, which is essential to the banking business. Buffet prefers companies that make money based on their business model, and the financial sector is an attractive fit for this philosophy.

Sustainable Energy is the Future

Buffet has always taken an interest in renewable energy, as he believes it is the future of energy sources. Buffet’s company, Berkshire Hathaway, has invested around $19 billion in renewable energy projects. The company primarily owns a range of wind and solar energy entities spread throughout the United States. Interestingly, his investments in renewable energy have dropped in recent years. This could be because Buffet believes that the energy sector is changing, and he is seeing more opportunities outside of green energy.

Buffet’s Strategy for Successful Investing

Buffet’s investment strategy has remained unchanged for many years. He is a value investor who looks for stable, high-performing companies with long-standing business models. He invests in companies that have a history of strong growth and management teams that have strong track records of success. Additionally, he believes that patience is key when investing, and he expects to hold his positions for the long run. Buffet also believes in the importance of diversification and recommends that investors spread their money among various industries to reduce risk.

Conclusion

In conclusion, Buffet’s investment strategy is consistent with his investing philosophy. He continues to invest in companies that have a strong business foundation, stable finances, and a proven track record of success. Buffet’s interest in Apple, the financial industry, and renewable energy is not only a reflection of these key principles but also represents the future of business models and technology.

- Apple

- American Express

- JPMorgan Chase

Contents

Most searched products:

The Ultimate Guide to Azealic Acid: Benefits, Uses, and Side Effects

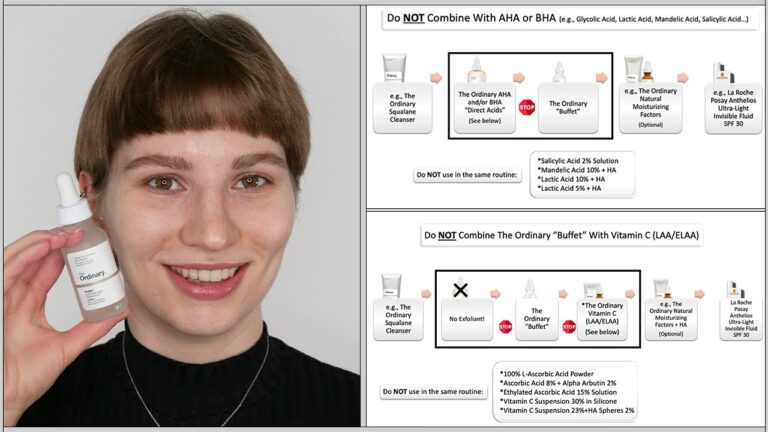

How Long Should You Leave on The Ordinary AHA BHA? The Ultimate Guide

Get brighter and smoother underarms with the original underarm brightening cream

How to Find Your Perfect Shade: The Ordinary Foundation Color Match Guide

Exploring the Fascinating World of The Ordinart: A Comprehensive Guide

The Importance of Upholding Integrity in Today’s World

10 Best Boots Retinol Cream Reviews – Expert Opinion & Buying Guide

10 Effective Skin Psoriasis Treatment Options for Clearer Skin

The Ultimate Guide to Using The Ordinary Hydrochloric Acid: Benefits and Precautions

The Ultimate Guide to Zinc and Hydrochloric Acid Reaction